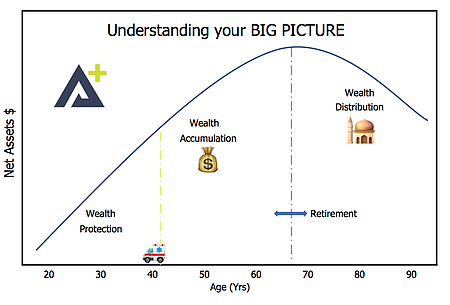

Your Big Picture

Understanding the big picture is our focus. We can capture your current financial position, and convert your aspirations, goals and dreams into a financial model that is condensed into one page. Failing to plan is a plan to fail. Let us help you:

- Manage your costs (especially your income tax)

- Review your loan arrangements

- Build your investment base

- Understand your risk/insurance exposures

- Plan superannuation contributions

- Arrange your finances to build wealth

- Assess your needs in retirement

Property Investment and Gearing

Australians love investing in bricks and mortar. And why not? And there is no doubt that there is wealth to be made from real estate investment, particularly property in our capital cities. But property investment is not without its challenges or risks. Getting the structure wrong can be expensive, greatly limit your options and place undue financial stress on you. To maximise the wealth creation opportunity, ensuring there is sufficient cashflow to support the property loan and expenses is the key We meet investors for the first time who’ve never heard about building depreciation reports. Or they have consolidated their investment and private loans to their detriment. We have decades of experience in guiding clients to successfully invest in property. Let us help you:

- Prepare cashflow reports

- Better understand the risks of investing

- Review yield and capital growth estimates

- Structure and finance the investment

Want to confidently maximise your gain from property investment? Talk to our team today.

Estate Planning

“Death never takes a wise man by surprise, he is always ready to go” Jean d la Fontaine (1621 – 1695).

A cynical lawyer once wrote: “Never let the assets of a good estate be waisted on the beneficiaries.”

Is your estate planning in order? It is critical everyone, of any age, knows what will happen to their affairs on their death or incapacity.

Many people are unaware that some assets don’t form part of your estate. Assets held in company or trust structures, superannuation assets or any jointly held property etc, may be dealt with independently of your Will.

Attorney and Guardian documents play an important role in the event of incapacity. Choosing the right attorney’s and Guardian’s should not be made lightly.

The best Estate Plans are done when your financial advisor works with your solicitor to develop a comprehensive plan.